Blind boxes crack success code

Pop Mart's trendy toys gain popularity among the world's young female consumers

Even till the end of September 2019, Beijing-headquartered Pop Mart, a company that makes trendy toys packaged randomly in what are called blind boxes or mystery boxes, hardly had any cross-border e-commerce presence.

Fast forward to last year's Singles Day shopping festival from Nov 1 to Nov 11-Pop Mart topped the sales in the action and toy figures category on AliExpress, a cross-border e-commerce platform based in China.

Sales on Tmall alone clocked 142 million yuan ($22 million), exceeding that of global toy brands, including Disney and Lego.

Exactly a month later, when it made its IPO in Hong Kong, Pop Mart's shares were oversubscribed by 356 times, valuing the company at more than HK$100 billion ($12.9 billion) on its first day of trading.

It confirmed the company's founder Wang Ning, 33, a billionaire now with a 57 percent stake, was not joking when he said he would like to make Pop Mart the Chinese equivalent of Disney or Netflix.

Next up: an ambitious plan to make the Chinese toys globally popular riding online social networks, overseas Chinese communities and Asian consumers.

The meteoric rise of Pop Mart appears unstoppable. That is surprising because the retail format of selling toys packed in blind boxes actually started in Japan.

In China, the company's products retail at about $9 each on average, and are widely popular. An unidentified loyal collector of Pop Mart's toys told Forbes magazine: "Blind boxes are so much different from what I have seen in the past. I like the toys' design, and the experience is a bit of a guess."

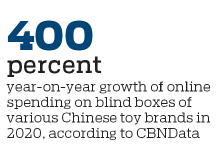

According to CBNData's report on the 2020 cross-border export consumption trend, online spending on blind boxes of various Chinese toy brands saw an explosive growth of more than 400 percent last year, with sales seen in more than 120 countries and regions. Female consumers accounted for about 75 percent of toy buyers, and young consumers aged 18-34 generated 78 percent of sales.

Justin Moon (Moon Duk Il), vice-president of Pop Mart and head of its overseas business center, said the company established joint ventures in fast-growing markets like Singapore, South Korea and Japan.

Its sales network now covers 21 countries and regions. The figure could have been higher but for the COVID-19 pandemic that led to postponement of some store openings overseas last year.

Pop Mart's overseas sales across wholesale, retail and e-commerce channels reflect the pandemic's impact on local retail in every overseas market it operates in, said Moon.

Thankfully, the new year 2021 has seen sales via e-commerce gathering momentum, particularly on Pop Mart's official e-outlets on platforms such as AliExpress.

Be it the domestic market or overseas markets, Pop Mart's patrons tend to be the younger generation born after 1995, tech-savvy, inclusive and curious about fresh ideas, Moon said.

Most of its fans are located in Asia and North America. European and Russian consumers prefer to buy Pop Mart products on AliExpress, while North American consumers prefer to choose official websites and Amazon.

Localization is key to success, said Moon, who leads a team of around 40 employees hailing from different nations at the company's headquarters in Beijing.

As consumers in each market display a different background, local partnerships offer advantages, influencing management and operations. For example, e-commerce and retail stores operated by South Korean partners show a positive trend; Singaporean partners possess the advantage of the management of retailers; and Japanese partners are good at content operations.

"Our long-term view is to strengthen our brands, discover and incubate the world's leading intellectual properties and artists from the globe, and serve each local market," Moon said.

The business-to-business or B2B format dominates Pop Mart's overseas business. However, e-commerce and retail will soon grow to dominate the company's sales strategy.

"For an enterprise to develop overseas markets, it needs a team that can deal with multiple foreign languages, understand multicultural elements, and has rich management experience. Now, we have some foreign employees, and we also work with foreign management teams, which can help us achieve better localization development," he said.

For South Korean native Moon Duk Il, who had been in charge of overseas operations for major South Korean business giants for 17 years, helping a Chinese cultural products company go global has proved to be a stiff but enjoyable challenge and a steep learning curve.

Prior to joining Pop Mart in 2018, Moon was part of senior management at a major South Korean company's Beijing branch. He joined the Chinese startup as its founder Wang, an alumnus of Peking University's business school like him, sought him out.

"I was impressed by Pop Mart's strengths in its creative business model and the founding team's support," he said. Pop Mart's asset-light business model is based on contract manufacturing. Top toy makers in Guangdong province that manufacture for the world's leading toy producers, also make Pop Mart products.

In Moon's view, a Chinese company such as Pop Mart that wants to explore international opportunities will have to deal with more uncertainties and risks than companies with focus on the domestic market. "Long-term development and patience are what matter the most."

Chinese cultural products such as pop toys have often found resonance among consumers in overseas markets in Asia as there are similarities in Asian culture and mindsets.

"Generally, Asian consumers prefer petite and cute toys with mysterious packages," said Moon. "But Western consumers are more interested in large-sized toys with cool functions and a sense of certainty."

When Pop Mart's products were first introduced in the United States, many consumers did not accept the concept of "blind boxes". Finding a product inside the packaging box different from the images displayed outside and on e-commerce platforms was a bit uncool. Post-purchase returns from buyers were high.

But sustained awareness campaigns on social media helped educate consumers in North America, gradually pushing them to embrace the concept of blind boxes.

But beyond such differences relating to cultural nuances, art and toys should not be limited by considerations like where they are produced but by where the "soul" is, said Moon.

Pop Mart has invited global artists to design its toys, and many of its future products could be local designs available only in a particular local market.

For example, pucky janggu is a traditional Korean drum much liked by Korean consumers. So, a figurine with a toy drum was released by Pop Mart only in South Korea in November. It was a runaway hit in the local market.

"The localized designs in South Korea are our testing programs," Moon said. "Once they prove successful, we will try to implement the practice in other overseas markets.

"Doing business overseas is like planting a good seed in foreign soil. It's best to mix the seed with local seeds for them to grow stronger together," he said.

wangzhuoqiong@chinadaily.com.cn