Shanghai incentivizing Thai investment

No shortage of opportunities for new business ventures

Shanghai, a bustling metropolis in East China, has been an attractive business destination for global investors since the nation's reform and opening-up in the 1980s. In its ongoing pursuit of exemplary development, the city is eager to expand its partnerships with Thai companies to ensure mutual long-term prosperity.

According to officials from Shanghai's commission of commerce, Shanghai and Thailand could deepen cooperation in trade, high-end manufacturing and innovation to unlock more business potential in coming years. The city is also seeking to expand partnerships with Thai businesses to promote innovation in fields such as industrial design, digital transformation, green development, tourism, and healthcare.

In prioritizing quality development, Shanghai has identified three key industries — integrated circuits, biomedicine and artificial intelligence — as well as advanced manufacturing and consumption.Tremendous opportunities are also forecast in emerging sectors such as metaverse technology and green transition.

"Thailand has released a 20-year development plan called 'Thailand 4.0', aimed at transitioning from an economy that is dependent on producing existing products designed by others to one led by innovation, research and development," said an official from Shanghai Commission of Commerce. "Against this backdrop, investment and cooperation between Shanghai and Thailand are essential."

Shanghai is home to more than 60,000 foreign-funded enterprises and boasts 891 headquarters of foreign companies and 531 foreign-invested R&D centers. Global investors cite the city's solid industrial development, complete industrial chain, diversified economy and favorable regulatory climate as major draws. Its significant investments in infrastructure, innovation, modern transportation systems, education and start-up support are other attractions.

Shanghai attracted 1,375 major investment projects in 2022,totaling over 1.2 trillion yuan($173.33 billion), and according to officials from the city's commission of commerce, the trade volume between Shanghai and Thailand reached 86.6 billion yuan — a 4.76 percent year-on-year increase. In 2022, Thailand investors set up 10 new businesses in Shanghai with a total investment of $9.14 million.

Top investment spot

Phaichit Viboontanasarn, vice-president and secretary-general of the Thai Chamber of Commerce in China, was recently asked to define the key characteristics of Shanghai. He chose the Chinese idiom "hai na bai chuan", which translates to "the sea embracing all rivers". This term is used to describe an open-mindedness that accommodates different businesses and ideas, much like an ocean accommodating rivers from all directions.

"Excellent business models, talents, technology, and culture from around the world collide and precipitate new fruits here," he said."With the comprehensive promotion of the Chinese path to modernization, Shanghai will be the vanguard of the journey".

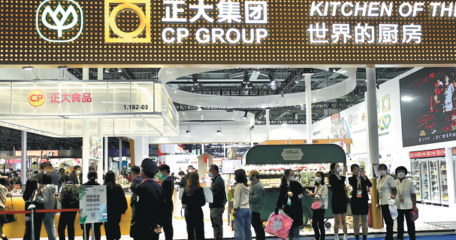

Major Thai enterprises like Charoen Pokphand Group, Bangkok Bank, Saha-Union Investment, and Thai Eastern Industries have all established footholds in the city."Whether in the fields of finance, logistics, manufacturing, international trade, services, or fast-moving consumer goods, Thai companies use their professional experience and uphold the traditional friendship of 'China-Thailand Family' to participate in and witness the development process of Shanghai," said Viboontanasarn.

"The first and foremost factor considered by Thai enterprises in judging an investment destination is a high degree of political and economic stability, followed by a big and growing market size and a well-developed ecosystem of the industry. Shanghai has always had a top score in those fields."

Continuing expansion

CP Group began its journey in Shanghai with a joint venture with SAIC Motors to produce motorcycles in 1985. As of today, the group has invested $2.4 billion in 15 projects in the industrial, agricultural, financial, real estate, commercial retail and import and export sectors.

"Shanghai offers the best investment environment, providing excellent opportunities for mutually beneficial and profitable investments," said Thanakorn Seriburi, senior vice-president of Chia Tai Group of Companies.

Over the past 38 years, CP Group achieved many "firsts" in China, including becoming the first foreign enterprise to invest in a domestic television production when the Zhengda Variety Show debuted on China Central Television in 1990. The group also funded construction of CP Plaza, one of Shanghai's largest shopping centers, in the city's Lujiazui district in 2002.

"CP Group has been impressed by the city's dynamic spirit of constant transformation and its core values of openness, innovation, and inclusiveness. Additionally, CP Group has appreciated the government's efficient work style, which prioritizes integrity, standardization, and a commitment to keeping promises. These factors have collectively contributed to creating a favorable investment environment in Shanghai for CP Group," said Seriburi.

Seriburi said CP Group would continue investing in Shanghai, particularly in the commercial retail industry that was affected by the pandemic. It will restructure its commercial retail business to support Shanghai as a global consumption hub while focusing on the pharmaceutical, manufacturing, automotive and livelihood support industries to create new business opportunities.

Kasikornbank, also known as Kbank, one of Thailand's leading financial institutions, launched its Shanghai branch in 2017 and plans to set up a foreign limited partner fund management company and QFLP fund in the Lin-gang Special Area of the China (Shanghai) Pilot Free Trade Zone to further consolidate its growth. The bank is applying for a quota of 1.5 billion yuan.

"Shanghai offers a vibrant and supportive ecosystem for investment," said Natthorn Chaiyapruk, senior vice-president of Kasikornbank. "This QFLP Fund establishment in Shanghai will be an important move of KBank entering the private equity investment market in China. It will create synergies among KBank's resources and partners to further enhance our business development in China and the ASEAN Economic Community."

Chaiyapruk cited three factors in choosing Lin-gang for the new project: strong policy stimulation covering tax incentives, cross-border fund facilitation and tariff preferences; sound business environment and a growing industrial ecosystem which focuses on developing high technology, financial services and advanced manufacturing industries. The Lin-gang Special Area was established in 2019 and has become a hub of industries such as advanced manufacturing, international trade, cross-border financial services, modern shipping and innovation.

Driving to a bright future

Shanghai will maximize its advantages to play a larger role in supporting global investors toward bigger goals in the post-pandemic era. This year, to further enhance the city's appeal to investors, the Shanghai government has implemented policies to ease market access and increase support for innovation and entrepreneurship.

During the Shanghai Global Investment Promotion Conference on April 6, the city announced 24 new investment promotion policies, including incentive plans to strengthen the confidence of global investors and attract major projects to the region.

For example, headquarters projects can qualify for a subsidy of up to 10 million yuan for property purchase or leasing, and major investment projects can receive up to 100 million yuan. Discount loans and financing leasing subsidies will also be provided to businesses that plan to expand production capacity.

Shanghai is also poised to welcome more Thai investors with professional platforms and services. The city's China International Import Expo, held annually in November, has become a key platform to provide Thai businesses with insight about China. It is also of great importance in introducing food and agricultural products to Chinese consumers.

Since 2018, Orient International(Holding) Co, a leading local service provider, has introduced more than 10 Thai enterprises to the CIIE with a total exhibition area spanning more than 2,000 square meters, to showcase fruit products, latex products, clothing and jewelry. Jin Danyan, general manager of Orient International Business Group, pointed out that the Regional Comprehensive Economic Partnership, signed in 2022, will boost trade between China and Thailand.

Connecting businesses

Shanghai serves as both a pivot for Thai businesses seeking investment opportunities in China and a bridge linking Chinese enterprises with Thailand.

According to the city's commission of commerce, between 2012 and 2022, 52 projects directly invested by enterprises and organizations from Shanghai were launched in Thailand.

In March, China's new energy vehicle brand Neta, which landed its management headquarters, R&D center and marketing functions in Shanghai in 2021, set up a manufacturing base in Bangkok to produce right-hand drive electric vehicles and support exports throughout member countries of the Association of Southeast Asian Nations. It also signed a partnership agreement with the Thai company BGAC to establish a modern electric vehicle assembly base to help build a green electric vehicle ecosystem in Thailand.

These two moves signify Neta's entry into a new phase of fast and stable development in the ASEAN, marking a new milestone in its globalization efforts, according to the company. The company said the reasons for establishing a presence in Shanghai are the city's talented workforce, geographical advantages and strong economic foundation.

Bank of China Shanghai branch, which serves a large number of foreign enterprises in Shanghai, is also eager to utilize its expertise to support Thai businesses in establishing a presence in the city. Leveraging its experience in serving numerous Fortune 500 companies and foreign-funded headquarters, the bank provides comprehensive and integrated financial services for Thai investors as well as global cash management and centralized management products.

Building on its international advantages and expertise in areas such as technology finance, cross-border finance, and supply chain finance, Bank of China continues to innovate its product system and improve its financial service capabilities. This provides strong financial support for more Thai enterprises investing and developing in Shanghai.

tangzhihao@chinadaily.com.cn