UnionPay accelerates Asia-Pacific mobile payment business layout

Consumer cross-border payment habits are changing. Union-Pay International data show that during the May Day holiday, the number of transactions completed by cardholders from the Chinese mainland through UnionPay mobile payment in popular destinations such as Thailand and Singapore as well as China's Hong Kong and Macao increased by several times compared with the same period of 2019.

This significant increase reflects the growing ambition of UnionPay and its continuous improvement of layout in the field of cross-border payments.

At present, UnionPay cards are accepted in 181 countries and regions around the world, and more than half of them accept UnionPay mobile payment.

Of the 78 countries and regions outside the Chinese mainland that have issued UnionPay cards, more than 30 have implemented UnionPay standards-compliant e-wallet products. Consumers, whether carrying UnionPay cards or mobile phones, can enjoy safe and convenient UnionPay payment services around the world.

Outbound Chinese tourists

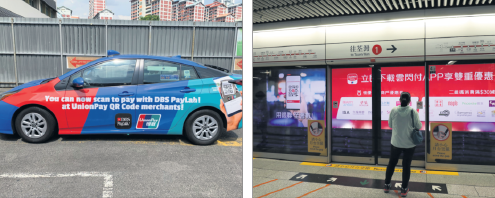

UnionPay mobile payment services are becoming more usable.The most intuitive experience is that more merchants outside the Chinese mainland support UnionPay QR codes.

With the resumption of cross-border personnel movement, a large number of overseas merchants have taken UnionPay mobile payment as an important way to improve their service capabilities and attract international tourists.

All merchants under ZeroPay, a South Korean mobile payment service provider, and merchants accepting mobile payment in Sri Lanka, a famous tourist destination in South Asia, now support UnionPay mobile payment.

With these business results, more than 16 million merchants across 98 countries and regions outside the Chinese mainland accept UnionPay mobile payment.

Especially in the Asia-Pacific region, the services are supported in Japan, South Korea and all 10 members of the Association of Southeast Asian Nations as well as China's Hong Kong and Macao.According to a report by Juniper Research, a British consulting firm, UnionPay International has been at the forefront of global digital payment companies in the field of QR code payment.

Based on the increasingly extensive mobile payment network, UnionPay International continues to promote the ecological and systematic development of overseas mobile payment scenarios in response to consumers' payment habits.

It has formed service characteristics to cater to people's life scenarios such as transportation, catering and retail.

Taking public transport scenarios that many tourists are concerned about as an example, the Hong Kong MTR and Fukuoka Metro in Japan support UnionPay cardholders to tap their mobile phones to cross the gate. Malaysia KLIA Ekspres and KLIA Transit, as well as subways, buses and taxis in Tokyo also support UnionPay Mobile QuickPass or UnionPay QR code payment.

For consumers, another advantage of UnionPay mobile payment lies in the diversity of products: UnionPay App, a mobile payment product, has more than 500 million registered users, while UnionPay mobile QuickPass covers different mobile phone brands including Huawei, Xiaomi, OPPO, vivo, Meizu, Apple and Samsung.

It is worth mentioning that UnionPay also uses the advantages of the platform under the "four-party model" to open up the QR code acceptance network and diversified application scenarios to access banking apps, enriching consumers' payment options overseas. At present, many banking apps in the Chinese mainland support cross-border QR code functions.

These apps can be used at more than 4 million merchants in 45 overseas countries and regions that have accepted UnionPay mobile payment.

Business localization

While assisting Chinese tourists, business travelers and international students, UnionPay mobile payment services are benefiting more overseas residents.

In recent years, the digital transformation of the global payment industry has been accelerating, in which UnionPay has participated. UnionPay has been contributing "China Solutions" to the global payment industry with experience in developing mobile payments on the Chinese mainland.

In 2004, the first overseas UnionPay card was issued in Hong Kong. Since then, UnionPay has expanded its customer base from the Chinese mainland to the world.

Over the past two decades, the group of overseas UnionPay cardholders has been expanding, and UnionPay payment services have been continuously upgraded.

In response to the changes in consumer payment habits, Union-Pay has joined hands with all parties in the industry to accelerate the implementation of UnionPay standards-compliant e-wallet products overseas, supporting cardholders to bind UnionPay cards in local e-wallets, through which they can enjoy QR code payment at merchants accepting UnionPay QR codes around the world.

More than 170 such wallet products have landed overseas, covering over 30 countries and regions.More than 20 wallet products in Southeast Asia support UnionPay cards, including PayLah!, Singapore's largest mobile payment product, K Plus, Thailand's largest mobile banking platform.

These products have the characteristics of "one-time download, cross-border universal use", and users can enjoy a diversified payment experience of a scan, tap or click.

Some products integrate contactless, QR code and in-app payment to solve full-scenario payments in one mobile phone.Data show that one out of every four UnionPay card transactions issued overseas is completed by binding mobile payment tools.

Digital transformation has become an important growth point for the localization business of UnionPay International, driving more overseas residents to apply for and use UnionPay cards.

With digital card issuance technology, UnionPay International has launched UnionPay virtual card products, which allow overseas residents to conveniently apply to local e-wallet apps and enjoy high-quality UnionPay payment services without the need to collect a physical card.

At present, more than 30 million virtual cards have been issued outside the Chinese mainland.

Interconnected ecosystem

At present, UnionPay International has more than 2,500 partners around the world, from traditional financial institutions to payment companies, telecom groups, retail enterprises and more.

The wide recognition from its partners is inseparable from UnionPay International's core value of "sharing growth and win-win cooperation".

Taking the construction of QR code acceptance network as an example, UnionPay International has launched a QR code network interconnection cooperation solution while improving its own mobile payment acceptance network, supporting UnionPay products and overseas wallets to be used in each other's networks in both directions.

South Korea's ZeroPay and Sri Lanka's national payment network LankaPay have adopted this cooperation model.

At the same time, UnionPay International has transformed its technical capabilities into business capabilities and built more than 20 digital payment service platforms such as UnionPay Content Service Platform and SaaS Card Issuing Service Platform to support cooperative institutions to carry out UnionPay digital business with high efficiency and at low cost.

Taking the UCSP as an example, overseas institutions that have launched UnionPay standards-compliant e-wallet products can quickly access diversified merchants in multiple fields such as bill payment, transportation, daily life services, and entertainment, providing one-stop access to rich value-added services and improving the experience of e-wallet users.