Rise of NEV sector gives China edge in automobile market

China is transitioning from a follower to a leader in the global automotive landscape thanks to the rise of its new energy vehicle sector, company executives and analysts said.

Wang Chuanfu, chairman and president of Chinese car manufacturer BYD, said the trend of electrification is "irreversible" in the auto industry, and so is the growing momentum of the NEV sector.

The company, which is backed by legendary United States investor Warren Buffett, saw its 5 millionth NEV, a Denza N7, roll off the assembly line on Wednesday, making it the first automaker in the world to achieve the milestone.

Wang said it took BYD around 13 years to produce 1 million new energy vehicles since its first hybrid model was unveiled in December 2008.However, it took just 18 months for the company's cumulative NEV output to grow from 1 million to 3 million units, and nine more months to catapult the figure to the 5-million mark.

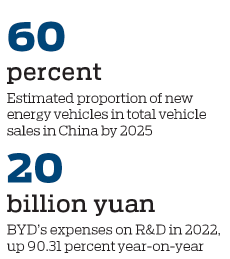

By 2025, NEVs are estimated to account for 60 percent of total vehicle sales in China, and domestic brands are expected to seize a 70-percent share of the country's automobile market, up from 50 percent in 2022, he said.

Chinese brands have been more popular in the NEV sector because of their speed of launching new models and the fancy onboard functions offered for tech-savvy Chinese consumers, said Edward Wang, an analyst at J.D. Power China.

Statistics from Gasgoo Auto Research Institute, a think tank for the automobile industry, showed that in the first half of the year, nine out of the 10 best-selling NEVs in the country were from Chinese brands, with the only exception being Tesla's Model 3, which ranked the 7th.

He Xiaopeng, CEO of Chinese electric car startup Xpeng, said the industry's model of one-way technological transfer from foreign automobile companies to Chinese ones, seen in the past decades, has been challenged.

In late July, Volkswagen reached an agreement with Xpeng to buy a 4.99 percent stake for around $700 million and to co-develop two models for the Chinese market.

The two models, which are scheduled for launch in 2026, will bear the Volkswagen brand but feature Xpeng's expertise in software and autonomous driving.

Volkswagen's decision to team up with Xpeng was based on its thorough research on enterprises and technologies in China, and on the recognition of Xpeng's edge in smart technologies, said He.

The startup, which is based in Guangzhou, Guangdong province, is known for its strong focus on technological innovation, with 40 percent of its staff being research and development personnel. Its R&D expenses reached 5.21 billion yuan ($723 million) in 2022.

Wang, chairman of BYD, said that R&D breakthroughs have been the driving force of China's rise in the NEV sector. The company's sales started to soar after its first model sporting its more efficient blade batteries was launched in 2021.

Wang said the company's R&D expenses exceeded its net profit in 11 of the past 12 years. In 2022, the figure reached 20 billion yuan, up 90.31 percent year-on-year.

As of July, BYD had over 90,000 R&D personnel, who had filed for over 40,000 patents across the world, with more than 28,000 of them already approved.

lifusheng@chinadaily.com.cn