CHINA'S INDUSTRIAL ROBOT MAKERS GEARING UP FOR GLOBAL EXPANSION

With major advances at home, manufacturers look to build on strengths, innovation

In the Singapore factory of electrical goods manufacturer Dyson, the air is devoid of human chatter, replaced instead by the rhythmic hum of cutting, conveyor belts, and the pulsating throb of machinery. Operators and engineers occasionally oversee the production process as more than 300 industrial robots transform raw materials into motors for Dyson vacuum cleaners.

In China, fostering new quality productive forces has become a key objective under the umbrella of the Industry 4.0 plan, and industrial robots that balance stability and flexibility are crucial to the strategy.

In 2022, China's industrial robot installations accounted for over 50 percent of the global total, with the nation emerging as a powerhouse in the realm of automation. China's manufacturing sector boasts a robot density of 392 units per 10,000 workers, the latest data from the Ministry of Industry and Information Technology showed.

In the past decade, domestically produced robots have found applications in nearly half of the country's key economic sectors. By 2025, China is aiming to double the 2020 density level of industrial robots in the manufacturing sector, the ministry said.

The sector's robot density in 2020 was 246 units per 10,000 workers.

Industrial robots now play a crucial role on production lines in industries such as automotive, electronics, food, and pharmaceuticals. By improving production efficiency and precision, industrial robots help enterprises lower costs and elevate their competitiveness, said Song Xiaogang, executive director of the China Robot Industry Alliance.

China's manufacturing sector is characterized by its vast scale and wide variety of categories, yet its level of automation still has room for improvement. This presents significant potential for the expansion of applications for domestically produced industrial robots, which are technologically advanced and cost-effective, Song said.

The industrial robot market in China experienced steady growth in 2023, with sales reaching 316,000 units, representing a year-on-year increase of 4.29 percent, according to a report released by the Gaogong Industry Research Institute.

Domestic strengths

A notable shift in market share between domestic and foreign manufacturers was seen last year. For the first time, domestically produced industrial robots accounted for more than half of the market share at 52.45 percent, according to the report.

Though China has solidified its position as the world's largest industrial robotics market, the country started out by focusing on bridging the gap with established players such as Japan, Germany, and the United States.

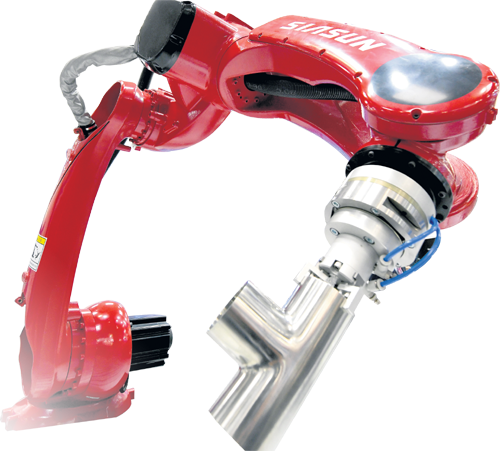

Siasun Robot & Automation Co was one of the first domestic enterprises to delve into research and application of robotics, and broke the long-standing market and technological barriers imposed by foreign products. As early as 2000, their robots were being used in construction machinery and motorcycle manufacturing.

With breakthroughs in multiple core technologies such as force sensors and offline programming, the company's industrial robotics has been widely applied in industries such as electronics, aerospace and engineering machinery. Siasun has also been involved in major national projects like the cross-sea highway project between Shenzhen and Zhongshan in Guangdong province, and the Gezhouba Dam hydropower project on the Yangtze River.

"The advancements have transformed China's industrial robotics landscape, reducing its reliance on imported technologies," said Zhang Jin, president of Siasun, which is located in Shenyang, Liaoning province.

However, despite these advances, international robotics giants such as Fanuc, ABB, Kuka, and Yaskawa, still have a large slice of the domestic market. This is particularly evident in the high-end section of the market, where domestic industrial robots face strong competition.

The global automotive industry, for instance, which accounts for nearly half of the demand for industrial robots, poses significant challenges for Chinese companies seeking to gain a foothold. Established foreign manufacturers currently dominate the industry, making it a daunting task for Chinese companies to carve out a space for themselves, said Yi Mingze, northern regional manager of Zhejiang Qianjiang Robot Co.

Domestic enterprises must prioritize investment in research and development to expand the scope of their core technologies. This approach is essential for reducing reliance on imports, particularly in areas where critical technologies are concerned, said Wang Yaonan, an academician with the Chinese Academy of Engineering.

Wider ambition

As latecomers to the sector, Chinese industrial robot makers have advantages and can accelerate their exploration of emerging industries and niche sectors, Wang said. By strategically developing specialized applications, these companies can enhance their market share and brand competitiveness, he added.

Yantai Aitron Robot Technology Co in Shandong province is reaping the rewards of rapid development in the new energy vehicle sector. Its load-carrying robots have achieved international performance standards at lower costs while providing quality interactive coordination services.

"As a result, many domestic NEV manufacturers have started procuring Aitron's products. The 360-kilogram load-carrying robot, in particular, has seen a constant supply shortage due to high demand," said Liu Jie, the company's deputy general manager.

Chinese industrial robot manufacturers are increasingly looking beyond the domestic market. With immense global potential, these companies are capitalizing on export opportunities to increase sales.

According to a report released by the International Federation of Robotics, industrial robot installations in Europe are on the rise. The 27 member states of the European Union installed nearly 72,000 industrial robots in 2022, a 6 percent year-on-year increase, the report said.

For European countries outside the EU, the total number of robot installations reached 84,000, a 3 percent increase on the previous year.

As early as 2007, Siasun began exporting its robot products. Today, the company's products are exported to over 40 countries and regions worldwide and are used by more than 4,000 companies, said Siasun's president, Zhang Jin.

Siasun is accelerating its international expansion. The company has established overseas subsidiaries and regional centers in Singapore, Thailand, Malaysia, Germany, and other locations, Zhang said.

This year, the company plans to further expand its global footprint by establishing a new overseas service center in Stuttgart, Germany, along with an overseas engineering service team, to enhance the performance of its local operations and better comprehend the needs of local consumers, Zhang said.

Challenges ahead

Despite these efforts by Chinese industrial robot companies, there are still several factors constraining their expansion into overseas markets.

Chinese industrial robots still lack sophistication in the high-end segment of the market, according to some experts.

International robotic giants integrate their products with the industrial internet, artificial intelligence, cloud computing, and the internet of things, to enhance the intelligence and capabilities of their products, said Huang Tian, a robotics expert at Tianjin University.

Establishing strong global sales and distribution networks is also crucial to improving brand recognition and expanding market reach. Learning from successful international brands, Chinese companies should invest in building a robust and efficient sales system that can penetrate and serve different overseas markets, Huang said.

This includes setting up partnerships with local companies that have established integration and distribution links, as well as providing comprehensive training and support to ensure customer satisfaction, he added.

By combining cost-effective products and customized solutions, domestic companies can provide good value that competes with international brands. This strategy not only aids market penetration but also fosters long-term customer relationships and loyalty, Huang said.

Contact the writers at wangkeju@chinadaily.com.cn